Overcoming increasing attacks

Contact centre fraud is now big business and with attacks become increasingly sophisticated, agents are working against the odds:

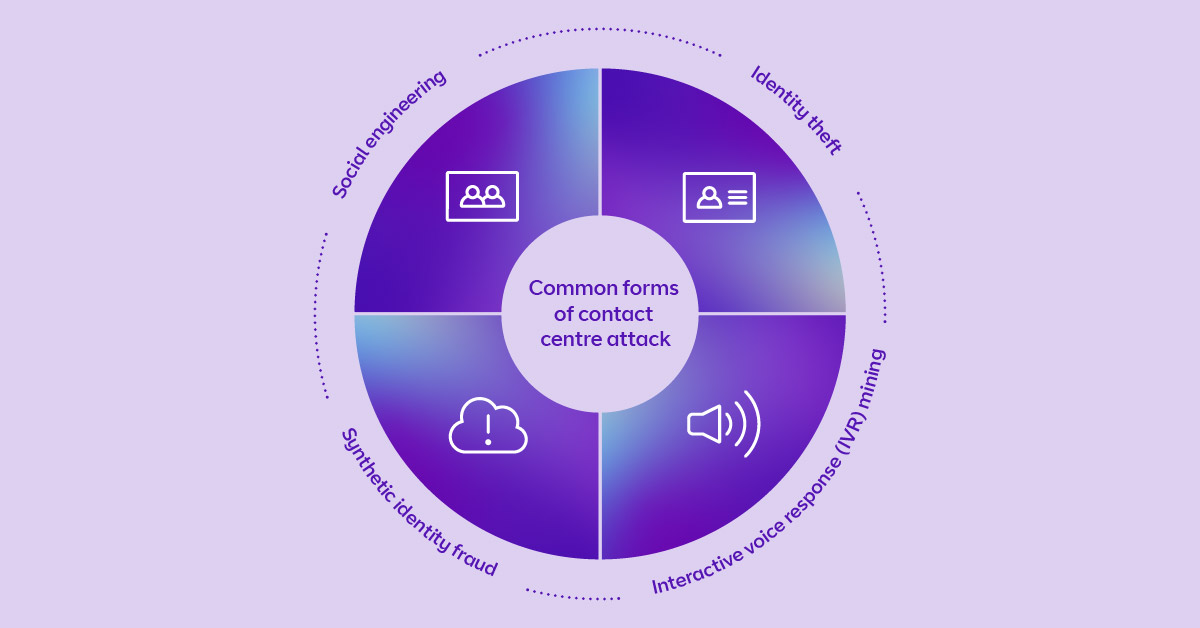

Common forms of attack

At present, these are some of the most common forms of malicious behaviour call centres encounter:

The stages of fraud

Fraudsters tend to follow a structured approach:

The growing cost of authentication

To combat fraud, the contact centre industry is investing heavily in authentication.

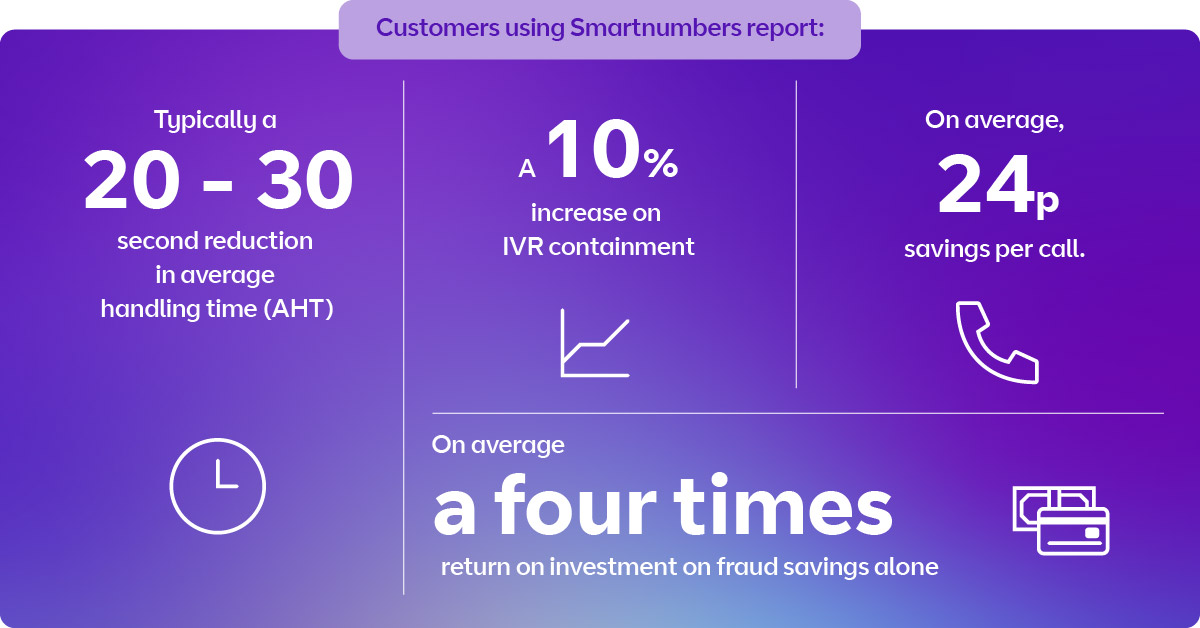

Introducing Smartnumbers Protect

Smartnumbers Protect verifies the authenticity of calls before they even reach an agent – using machine learning to analyse call signalling, caller behaviour and rapidly checking numbers against the fraud database. This provides frictionless experiences for genuine customers and diverts high risk calls to specialist teams. It also layers brilliantly with Nuance Gatekeeper to provide a multifactor authentication solution.

Introducing Nuance Gatekeeper

Nuance Gatekeeper replaces outdated verification factors with biometric authentication and intelligent fraud detection. The AI-powered solution is extremely difficult for fraudsters to defeat because it layers voice, conversational and behavioural biometrics to protect against a range of attacks. Plus, with passive verification, customers use their voice as their password, eliminating the need to remember obscure information and allowing secure, frictionless authentication.

Customers using Nuance report:

Why BT for security in the contact centre?

- Our detailed knowledge and experience of fighting fraud

We have a strong track record in helping customers defend their contact centres against telephony, card and online fraud. - We take an industry-specific approach

We have experience in implementing solutions across every sector, working with customers who have to navigate even the tightest of security regulations. - We understand customer experience

Our contact centre security solutions work for the consumer, as well as the enterprise. - Our valuable partnerships and strong alliances

We have strategic partnerships with Smartnumbers and Nuance, which means we can integrate these solutions into any contact centre.

A secure, satisfying experience for customers

Balance the risk of fraud with the importance of customer experience with an end-to-end secure contact centre, assisted by Smartnumbers Protect and Nuance Gatekeeper.